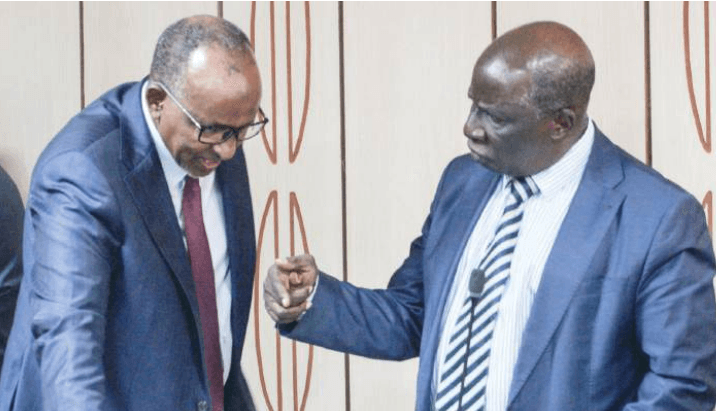

Desperate times require desperate measures. On Monday, new Central Bank Governor Kamau Thugge raised the bank's lending rate from 9.5 to 10.5 percent.

After the tax rises in the new Finance Act, this will put pressure on ordinary Kenyans who will have to pay more for bank loans. Small and medium-size companies will also find it more difficult to borrow as they will have to compete with high-interest Treasury Bills, which are totally safe as they are backed by the state.

On the other hand, the shilling has been steadily depreciating, despite the previous CBK Governor Patrick Njoroge fighting an unwinnable battle to keep it at around 120 to the US dollar. It is now 140 and sinking towards 150.

Thugge's interest rate rise will stabilise the shilling by giving a better return to depositors but it will crowd out local borrowers by making government bonds more attractive.

Ultimately it shows that you cannot fight the market. We have to let the shilling float. Once it finds its natural level, it will stabilise. Thugge's interest rate rise is a more effective strategy for protecting the shilling than Njoroge's substantial releases of forex reserves into the market.

Quote of the day: "I don't even call it violence when it's in self defense; I call it intelligence."

Malcolm X

The American activist formed the Organization of Afro-American Unity on June 28, 1964.