A 2.75 percent tax for the Social Health Insurance Fund has been proposed to replace NHIF. The new Affordable Housing Levy is 1.5 percent of gross salary. So the top rate of income tax will now be a steep 34.25 percent.

Government does need to raise tax collection to pay off the debts accumulated by the last government. But even the IMF says that tax raises should be phased in gradually.

These taxes are inherently inequitable because they are being paid by formal employees to benefit those who do not pay direct taxes.

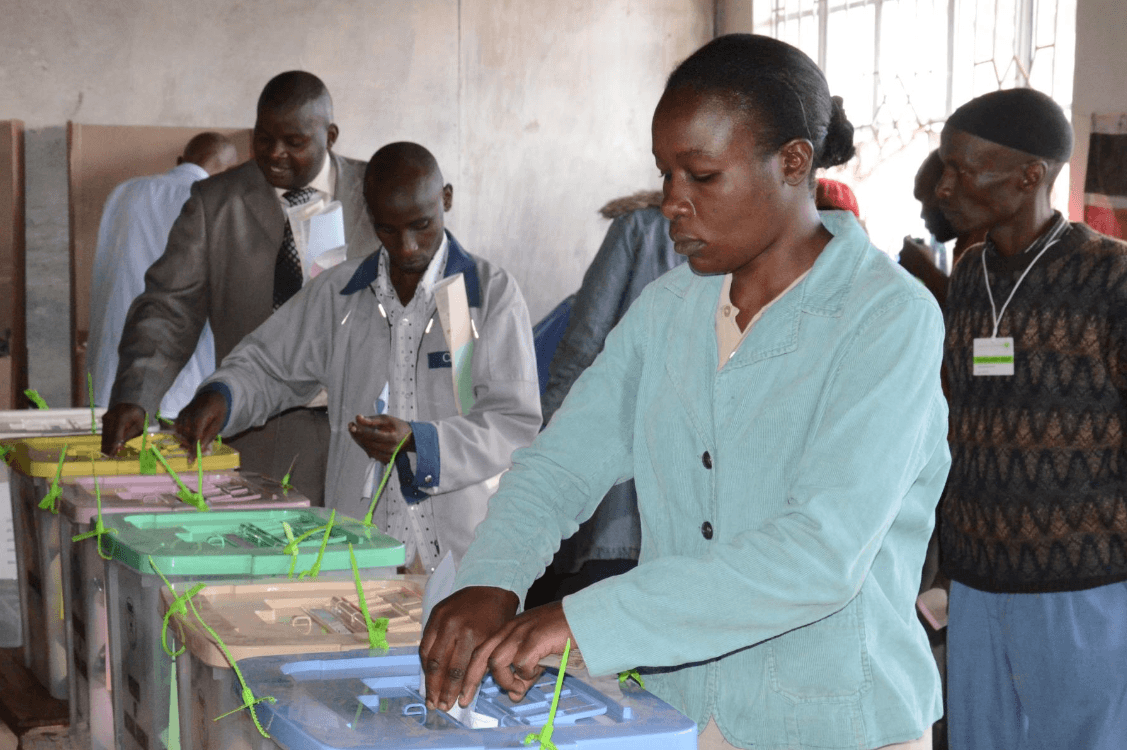

Around six million people pay tax in Kenya but only three million are registered to pay PAYE. So three million are paying health insurance and providing affordable housing for 20 million adults in Kenya (the number of registered voters). Is it fair for 15 percent of the adult population to support everyone else?

Government wants to reduce income inequality in society but these taxes on formal sector employees only increase it.

VAT is an indirect tax that touches everybody. Let it be increased from 16 to 18 percent as proposed. It hurts but at least it hurts everybody.

Quote of the day: "It does not matter how slowly you go as long as you do not stop."

Confucius

The Chinese philosopher was born on September 28, 551 BC

![[PHOTOS] How ODM@20 dinner went down](/_next/image?url=https%3A%2F%2Fcdn.radioafrica.digital%2Fimage%2F2025%2F11%2F99d04439-7d94-4ec5-8e18-899441a55b21.jpg&w=3840&q=100)