It is a cardinal rule of privatisation that you should not sell off monopolies. However there is no point in the state owning companies where the private sector is active and can do a better job.

The government is now planning to sell off various state companies. This should be done transparently for the highest price possible. The proceeds can used to help pay off the $2 billion Eurobond in June 2024.

There is no point in retaining the National Oil Corporation, which loses money and cannot compete with profitable companies like Rubis and Shell. Similarly, there is no strategic national interest to justify keeping rice mills that compete with the private sector.

The same applies to KICC, Kenya Literature Bureau, Kenya Seed Company, New Kenya Cooperative Creameries, Rivatex, etc. Sell them all off in an open tender and be done with them. Even if they don't bring in much cash, they will not require further subsidies.

However, the highly profitable Kenya Pipeline Company is an effective monopoly. Whoever buys it could make windfall profits by upping its charges because there is no competition. So KPC's rates for transporting fuel will need to be carefully regulated.

Quote of the day: "Genius is one percent inspiration and ninety-nine percent perspiration."

Thomas Edison

The American inventor first demonstrated his phonograph on November 29, 1877

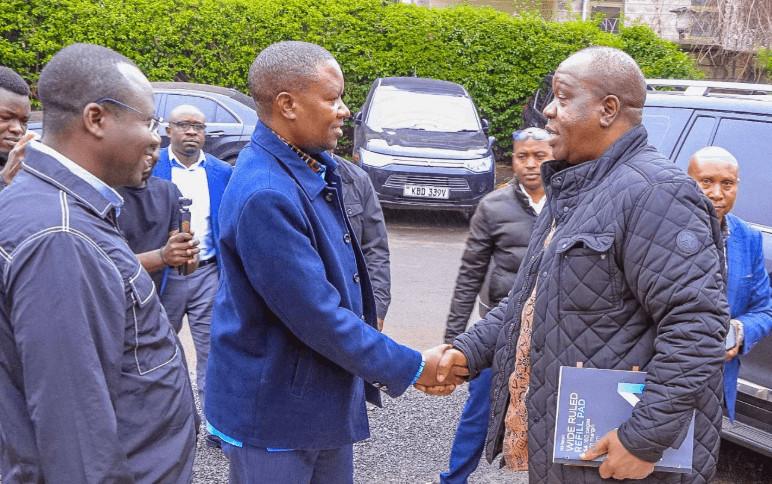

![[PHOTOS] Uhuru leads Jubilee grassroots meeting in Murang’a](/_next/image?url=https%3A%2F%2Fcdn.radioafrica.digital%2Fimage%2F2025%2F11%2F0b2a49cd-52fb-4a92-b9dc-26e253825a4a.jpeg&w=3840&q=100)