Last month, this column had an in-depth look at why Kenya’s textile industry is struggling for survival amidst cheap imports and pressure from powerful foreign governments to keep the domestic market open.

Apart from cheap imports, industry players cited high costs of doing business, which raises the prices of textile products in Kenya compared to lower prices in neighbouring countries. In the article, retail trader Samuel Muraya told us that even small-scale vendors are affected by the high costs of processing cargo at the country’s ports.

The woes dragging down domestic textile production are not confined to that industrial sector. Every industry in Kenya is lamenting the rising cost of business, which makes imports cheaper than locally produced goods. Both producers and consumers say that consumer goods, agricultural produce, transport, fuel, hotels, hospital charges and school fees are higher in Kenya than in countries with an equivalent level of development.

Lots of industries prefer importing their products rather than making them in Kenya. Within your household are detergents made in Vietnam, toothpaste made in India, cooking oil from Malaysia and fruit juice from Egypt. Hardly any consumer electronics are made in Kenya.

HEAVY GOVERNMENT SPENDING

What makes doing business in Kenya so expensive? Taxes have a lot to do with it. The government is spending heavily and borrowing from local and international lenders. The growing debt forces the government to increase taxes to afford the loan repayments.

By September 2021, Kenya’s total debt stood at Sh7.99 trillion, according to a report by the Controller of Budget. Between June 2021 and January 2022, the government spent three times more money repaying loans than it sent to county governments.

Government officials justify the increase in taxes as necessary to develop the country. “The amount of taxes people pay in Kenya is nothing compared to what they are paying in Europe, nothing,” government spokesman Cyrus Oguna said during a press briefing. “So you are crying when actually you shouldn’t be crying.”

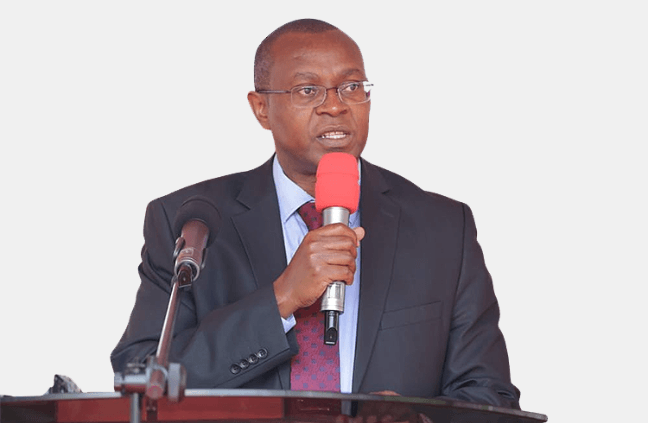

Kenya Revenue Authority (KRA) commissioner general Githii Mburu has defended the tax collector from accusations of overly aggressive tax collection methods, which have included the closure of businesses during tax disputes. Last November, KRA announced it was monitoring social media to check for possible tax evaders leading opulent lifestyles.

"I want Kenyans to know that we are partners and we wish taxpayers well. We only aim to ensure that you are paying your rightful share of taxes," Mburu said.

County governments have also increased various fees to meet their revenue targets. Business licences, permits, parking charges and market fees are all on the rise, sparking street protests by small-scale traders across the country.

Kenya Association of Manufacturers (KAM) chairman Mucai Kunyiha blames the increase in taxes on wasteful government spending. He criticises what he calls 'ribbon disease' — the compulsion to open new buildings and infrastructure however ineffective or uncompetitive.

“Besides corruption, we have glaring challenges around parastatals that are constantly losing money, duplicity between national and county governments, and a culture of entitlement to high luxury in government,” Kunyiha says.

HARSH ENFORCEMENT OF RULES

While the government has a responsibility to ensure everyone sticks to the law, businesses have objected to the methods used to enforce regulations. Common tactics of state agencies include bans, closing business premises, raids, confiscating products, biased enforcement and heavy fines.

A popular post on social media shows a supermarket office filled with framed copies of more than a dozen licences needed to run the business. There’s the single business permit, fire certificate, health, occupational safety, KRA Pin, music copyright and performance rights, among others.

Have you branded your premises? The county government demands a licence for it. There’s an ongoing controversy over whether branded corporate vehicles should be licensed only at the county of origin, or in every county the vehicle goes to.

County governments do building approvals, but so does the National Construction Authority and the National Environment Management Authority. Some county governments are proposing to charge hotels an annual fee for each bed in their establishments.

“When we have multiple regulators, the temptation by each is to raise resources to finance their existence. This creates costs to the citizens who are doing the producing and dampens productivity, and worse, is a disincentive to invest,” Kunyiha explains.

EXPENSIVE ENERGY

Manufacturers often criticise Kenya’s fuel and electricity prices as being higher than those of other countries in East Africa. While electricity prices in Kenya range between Sh15 and Sh21 per unit of power, manufacturers in Uganda pay Sh10. The cost of electricity in Tanzania stands at the equivalent of Sh14 per unit.

Fuel prices are also higher than the regional average, with petrol prices in Nairobi currently at Sh129.72. The price of diesel in Nairobi is Sh110.60. Within these prices, 45 per cent consists of taxes and levies.

The outcry from consumers and industry pushed the government to subsidise fuel prices starting from 2021. The latest fuel price calculation by the Energy and Petroleum Regulatory Authority (EPRA) shows that without the subsidy, the price of petrol would be Sh14.53 higher, while diesel would be more expensive by Sh23.29. Critics say the fuel subsidy is not sustainable now that world oil prices are rising because of the Ukraine war.

The Jubilee administration tried to bring down electricity prices after getting into government in 2013. Billions of shillings were invested in geothermal stations at Olkaria. Money was put into geothermal exploration at Menengai and Baringo. The state and the private sector invested several billions into solar and wind energy.

By 2021, the heavy investments had not yielded the expected drop in electricity prices. President Uhuru Kenyatta ordered a probe into the electricity sector, which revealed massive inefficiencies within Kenya Power. Contracts signed with private power producers were heavily skewed to the disadvantage of electricity consumers.

CUTTING BUSINESS COSTS

In a nutshell, cutting the cost of doing business in Kenya entails dealing with the three main problems identified in this article. Government should cut taxes, enforce regulations fairly and reduce the prices of fuel and electricity. Taking these steps will not be easy because politicians want to implement costly social welfare programmes and build huge infrastructure projects.

KAM chairman Mucai Kunyiha believes that wasteful spending by officials is underpinned by the erroneous view that “the government has money”. He describes the view as, “A fallacy that ignores the fact that the only money government has is what it takes from its citizens as taxes.”