Kenya, Africa’s largest supplier of carbon credits, has joined a growing list of African countries embracing carbon trading rules to govern domestic trade in carbon and tap into a $2 billion market.

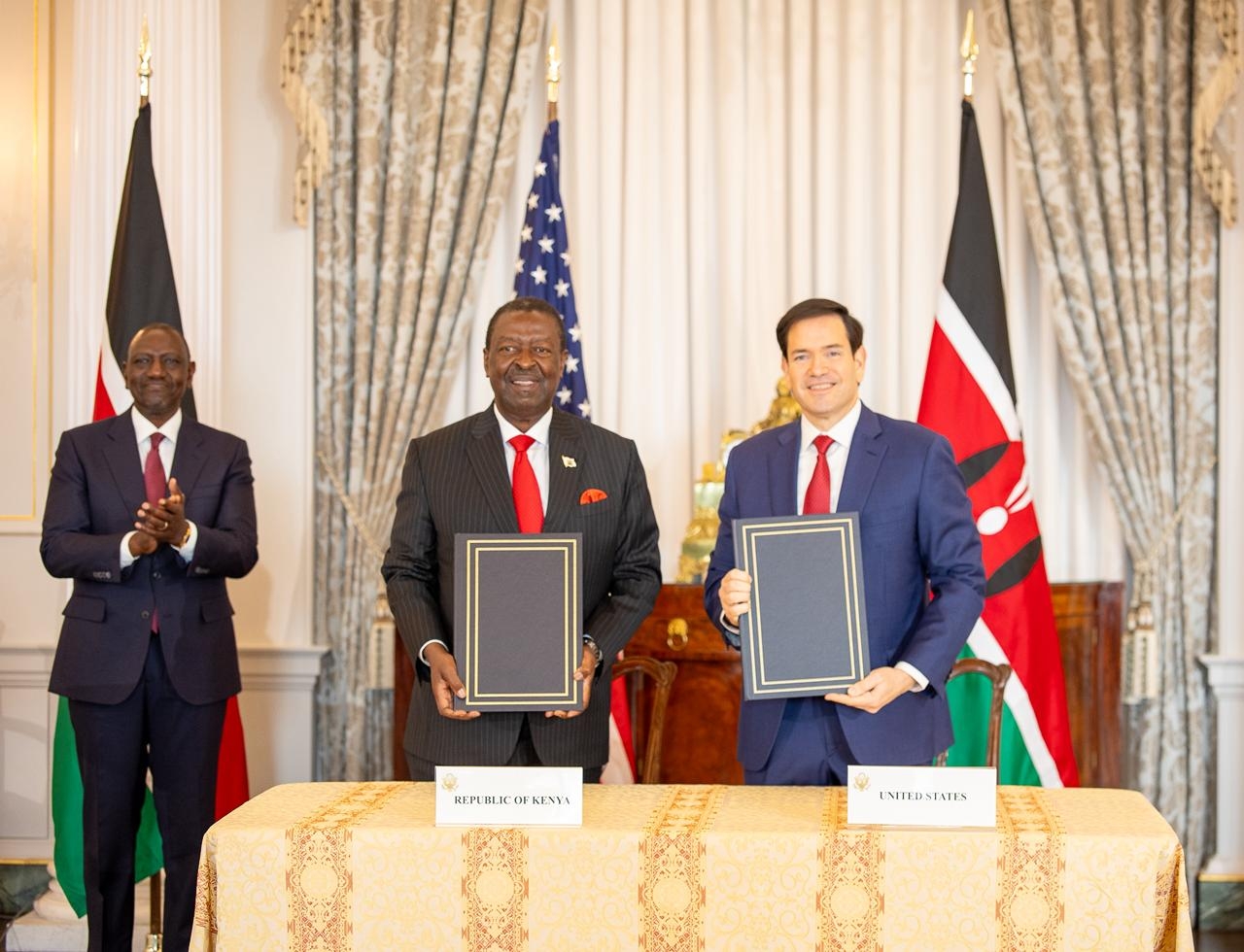

President William Ruto signed into law the Climate Change (Amendment) Bill 2023 on September 1, allowing Kenya to set up a national carbon registry and appoint an authority to run it.

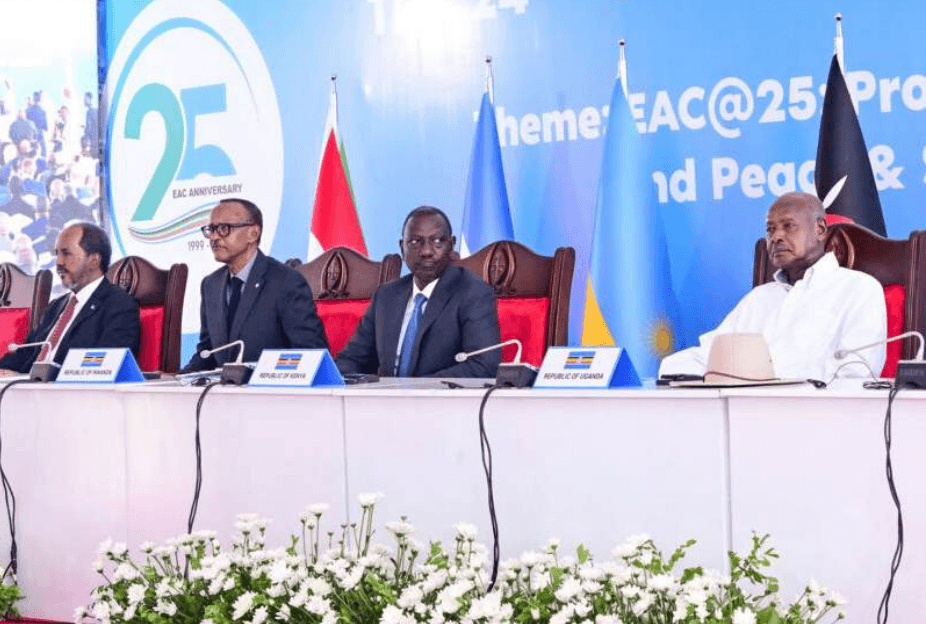

During the opening of the inaugural Africa Climate Summit in Nairobi, Ruto said the time was ripe for Africa to start monetising its massive carbon sinks.

“We have the carbon sink that serves the world, cleans our environment, acts as sequestration of carbon that is produced by others — but we get nothing for it. It’s not anywhere in our balance sheet,” Ruto said.

“The day we put our whole assets in our balance sheet, you will know we are a very wealthy continent.”

Under Kenya’s new climate change law, 40 per cent of earnings from annual carbon trading on land-based projects must be channelled to local communities as social contributions, while 25 per cent will be deducted from non-land-based projects.

While South Africa was the first African country to implement carbon regulations through its Carbon Tax Act No 15 of 2019, Gabon became the first African economy to start earning from carbon offsets, committing in 2021 not to clear forests in return for financing.

Over the last year, several other African countries have come up with their own rules stipulating how carbon trade-related revenues should be generated and shared. The rules generally encourage green investment inflows to help countries fix widening finance gaps.

“Countries in Africa are increasingly embracing carbon trading legislation to regulate and tap into the vast potential that carbon trading bears for countries in the global south,” said Arcon Law Advocates partner Omondi Owino.

Owino lists Zimbabwe, South Africa, Namibia and Tanzania among the African countries that have established regulatory frameworks to guide carbon trade.

In August, the Zimbabwean government said it would allow carbon credit developers to keep up to 70 per cent of carbon trade proceeds for the first 10 years, with the government receiving the remaining 30 per cent as an environmental levy. The government also called for the fresh registration of carbon developers.

In December 2022, Zambia's government launched interim guidelines for the country's carbon market aligned under the Paris Agreement, pending enactment of the country’s Climate Change Act, expected in 2023.

“The guidelines are meant to ensure that the country does not lose out on the carbon market but takes advantage and ensures Zambian people, especially the rural communities, benefit from this innovative source of climate financing,” said Zambian Minister of Green Economy and Environment, Collins Nzovu.

Zambia has been facilitating the implementation of carbon market projects ever since the adoption of the Kyoto Protocol in 1997, which gave emission reduction targets to industrialised countries.

According to Ghana’s International Carbon Market and Non-market Approaches Framework, the country aims to raise carbon finance to support its Nationally Determined Contributions (NDC) and drive foreign direct green investments to benefit local businesses.

“Ghana’s participation in the international carbon market complements the country’s domestic and international climate finance resource mobilisation efforts to implement NDC,” reads part of Ghana’s framework document.

“It also forms part of Ghana’s greenhouse gas mitigation policy package.”

Namibia is following a similar path by leveraging carbon trade proceeds to finance NDC gaps, while Malawi’s strides resemble those of Kenya after the country created an agency in June to oversee its trade and marketing of carbon emission offsets.

According to a non-profit, Climate Policy Initiative Report on Climate Finance Needs of African Countries, the continent faces a huge financing gap for its NDCs after raising $30 billion in 2020, a paltry 12 per cent of the estimated $250 billion in climate finance needed annually until 2030 to accelerate climate action.

Ruto affirmed to African delegates in Nairobi the urgent need to grow Africa’s green investments.

“We must see in green growth not just a climate imperative but also a fountain of multi-billion-dollar economic opportunities that Africa and the world are primed to capitalise on,” he said.

There are positive prospects in the form of the Africa Carbon Markets Initiative (ACMI) inaugurated at Egypt’s COP27 summit in 2022, with a target of mobilising carbon credits valued at $6 billion by 2030 to catalyse foreign investment.

The United Arab Emirates committed to buying $450 million of carbon credits through this initiative during the opening of this week's Africa Climate Summit.