As the country is inundated with very heavy rains caused by the El Niño climate phenomenon, lots of Kenyans are experiencing colossal financial losses from flood damage. Many of these people may never recover financially because their property was not insured.

Simply put, insurance is a contract between an insurance company and a policyholder, who could be an individual or an organisation. In the contract, the insurer promises to pay the policyholder if the event specified in the policy occurs.

In exchange, the policyholder promises to pay the insurer a premium to cover the risk. Insurance premiums may be paid monthly, quarterly or annually, depending on the contract.

Individuals and businesses that had insured their agricultural produce, livestock, motor vehicles and other assets against floods will get monetary compensation that will help them re-establish their businesses.

Sadly, most people who have lost out in the flooding will not benefit from insurance. The 2021 Financial Access Household Survey revealed that almost 70 per cent of Kenyans had never used insurance services.

The Insurance Regulatory Authority (IRA) acknowledges the situation, saying that the lack of insurance, combined with inadequate savings, are exposing Kenyans to external shocks.

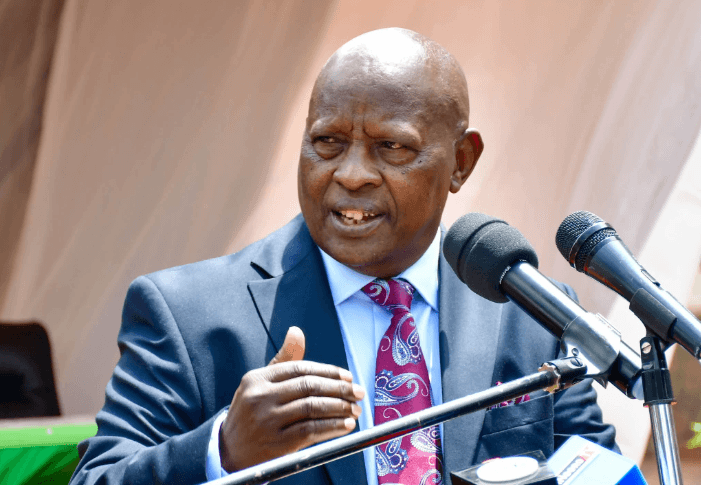

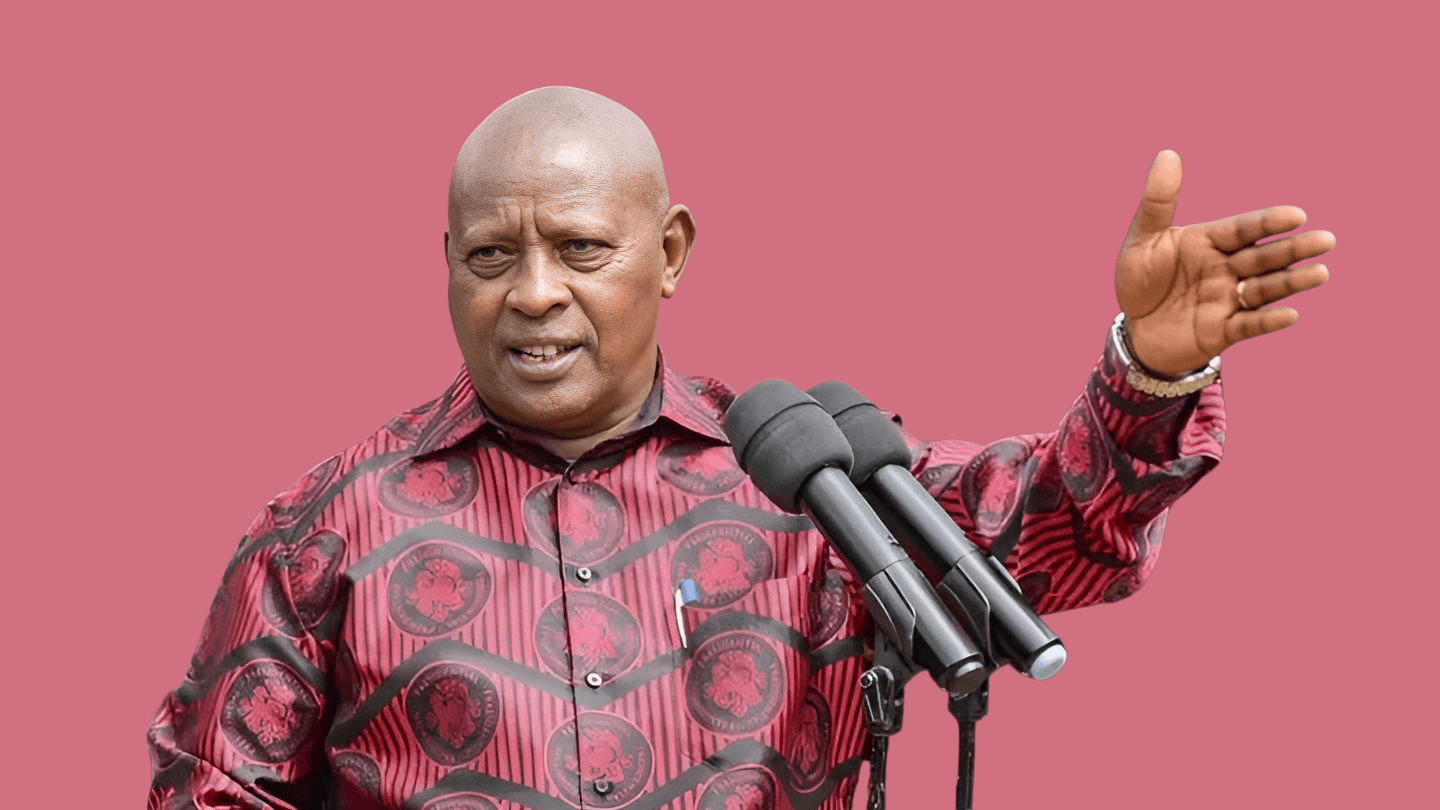

“While insurance services and products can offer a social safety net, insurance uptake and penetration in the continent is low," former IRA chairman Mwambu Mabonga said back in April.

The then-chairman attributed the situation to distrust of insurance companies, delays in settling claims, high cost of insurance premiums and poor management in some insurance companies.

The Association of Kenya Insurers (AKI) says that whenever a policyholder pays an insurance premium, the money is put into a pool from which claims are paid in case disaster strikes.

“Once you lodge a claim, depending on the type of policy you took, the insurance company will come in and assist through rebuilding or repairing, replacing, providing cash settlement or any other form of compensation as per policy agreement,” the association says in a statement.

Climate shocks may force Kenyans to seriously think of taking up insurance products against natural disasters. Within the first month of the current El Niño rains, more than 17,600 acres of farmland had been destroyed, with at least 13,400 heads of livestock reportedly killed. Those numbers represent monumental losses to the affected individuals.

The first step towards getting insurance is to find a reputable, licensed insurance agent. These agents or insurance brokers can help you find policies that match your business needs. Worth noting is that insurance brokers get commissions from insurance companies when they sell policies, so make sure you are buying a policy that is best suited for your needs.

Prices and benefits vary across insurance companies. It is, thus, advisable to shop around and compare rates, terms and benefits from several insurance agents. As you make your choice, think about what kind of accidents or natural disasters are likely to affect you and your business.

When you finally choose a particular insurance policy, carefully scrutinise the details to fully understand what's covered and what's excluded from the policy.