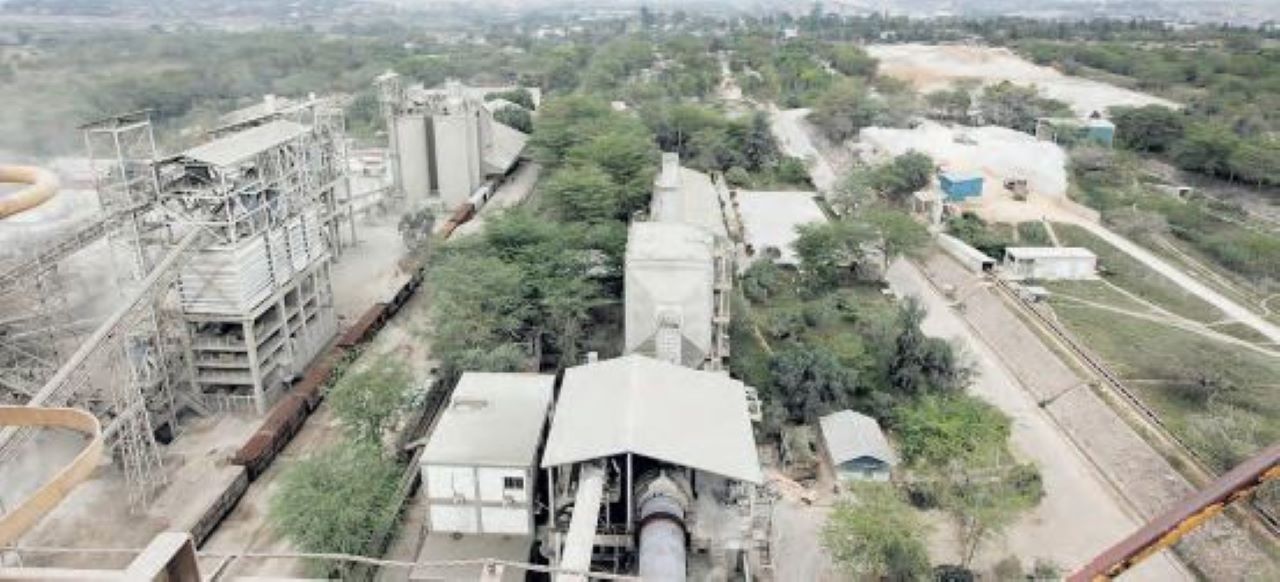

East African Portland Cement (EAPC) has contracted

the original developer of the facility to conduct a comprehensive technical

audit to inform investment decisions.

In an exclusive interview, EAPC acting managing director Mohamed Osman said the findings by the Danish firm; FLSmidth will guide the technological and capacity upgrade to be funded by some of the proceeds from the land sale.

“We have tapped FLSmidth to undertake a comprehensive technical audit of the plant, which will assess how to maximize the capacity and inform the design and cost of a new one,’’ Osman said. The audit by FLSmidth will also look at the reserves of raw materials that it has and inform whether it needs to acquire more land that has adequate reserves.

“Part of the work by the technical audit is to establish the deposit reserves, how long they can last and what strategic acquisitions we can do for strategic reserves and where,” Osman said.

“Some of our equipment was installed years ago, and a lot has changed, especially with the rising cost of power. We’re looking at adopting more energy-saving equipment, including exploring alternatives to coal like macadamia husks and other agricultural waste.’’

The 10-week audit process is expected to end in early December. The cement maker whose share is riding high at the Nairobi Securities Exchange (NSE) on positive market sentiment is expected to realize Sh9 billion from the land-selling exercise currently in progress.

The firm has been the 36th most traded stock on the NSE over the past three months, trading a total volume of 412,300 shares—in 304 deals—valued at Sh3.23 million, with an average of 6,544 traded shares per session. NSE market data shows the cement maker’s share price has shot from Sh8 at the end of 2023 to Sh45.45 on Tuesday, growing almost six-fold, making it the best-performing stock.

“We plan to plough back the proceeds of the sale of the idle land in Athi River to double cement production capacity over the next four years without necessarily relying on debt,’’ Osman said.

Some of the money, which has already been realized, was spent on refurbishing the plant earlier this year and is also expected to use some of the proceeds to pay dividends the first time in a decade. The company is regularizing its 1,907 acres of land, which has been occupied by the local community for many years, giving those squatters the first right of purchase.

By the exit of the whole programme, we expect to realize an exit value of Sh5.4 billion from the sale of land to the local community. We are also disposing of other parcels of land adjacent to this, which we anticipate to generate Sh3.5 billion,’’ the Acting boss told the Star. The cement maker plans to reinvest the proceeds of the sale of land to scale up its current plant’s clinker production capacity from 1,680 tonnes to 2,500 tonnes daily and eventually develop a new integrated cement plant with a capacity of 5,000 tonnes.

The two plants producing 7,500 tonnes of clinker every day would give the company the ability to produce 15,000 tonnes of cement daily. Osman further revealed that the firm has managed to cut on high operation cost and debt that has stuck it in losses in the past 10 years and is anticipating better results in the first six months of the year.

In addition to retiring the Sh6.8 billion in debt from KCB, it has more than halved its workforce costs from Sh240 million to Sh55 million through a well-thought-out restructuring.

© The Star 2024. All rights reserved

© The Star 2024. All rights reserved