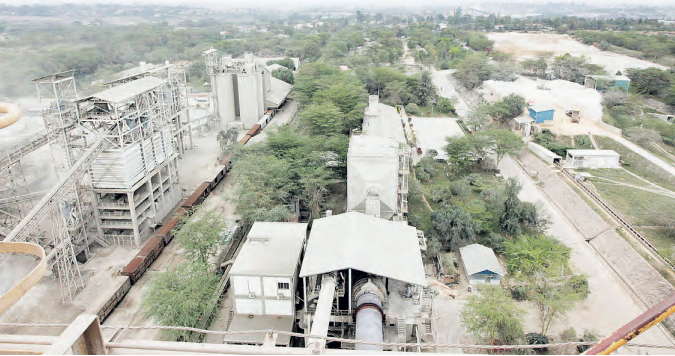

On Thursday, the East African Portland Cement Company posted

a Sh35 million half year profit for the period ended December 31, 2024, on

increased sales.

This is due to a sound turnaround strategy that saw it

capture a significant market share from rivals.

This saw it award shareholders Sh1 per share on Friday,

ending a 13-year dividend drought.

The twin good news saw the firm’s share price close February

strong among top gainers at the Nairobi bourse, having gained 27.5 per cent to

close at Sh37.

The recovery of the once loss-making cement maker is

expected to develop an investment plan that targets full utilisation of the

installed capacity within the second half of the financial year.

A share repurchase plan announced by Centum Plc last year

saw a dramatic rally of its share price at the Nairobi bourse, forcing the

diversified investment firm to halt the initiative on late January.

On Friday, the

stock’s price closed the month as the third biggest gainer, having reaped an

extra 29.96 per cent to hit Sh14.75.

Analysts, however, expect it to start sliding back to its

initial price of Sh11.90 or even to a buy back offer of Sh9.51.

The Standard Group share plans to raise Sh1.5 billion

through a rights issue aimed at restructuring its balance sheet to be able to

take advantage of emerging future opportunities for the business in a digital

era that continues to attract investors.

The move announced more than six months ago has seen the

firm’s share price at the NSE gain a massive 30 per cent to close February at

Sh6.50.

It is likely to progress or decline depending on the execution of the rights issue.