Kenya Development Corporation has moved to explain how it accumulated bad debt amounting to Sh33.4 billion as it allayed fears that it is sinking into a financial hole.

It comes after Auditor General Nancy Gathungu revealed that the agency was writing off the debt, as it was unable to recover it from borrowers.

In a statement, KDC said the amounts in question are loans disbursed to Kenyans by its predecessors decades ago but ballooned over time due to penalties and interests.

“It should be noted that KDC has a current loan book and a legacy loan book derived from the loans issued by its three predecessor entities; ICDC, IDB Capital, and TFC,” the agency said.

The Legacy Portfolio is part of its debt portfolio comprising historical loans advanced by the corporation’s predecessors to empower entrepreneurs in various sectors of the economy between 1965 and 2008.

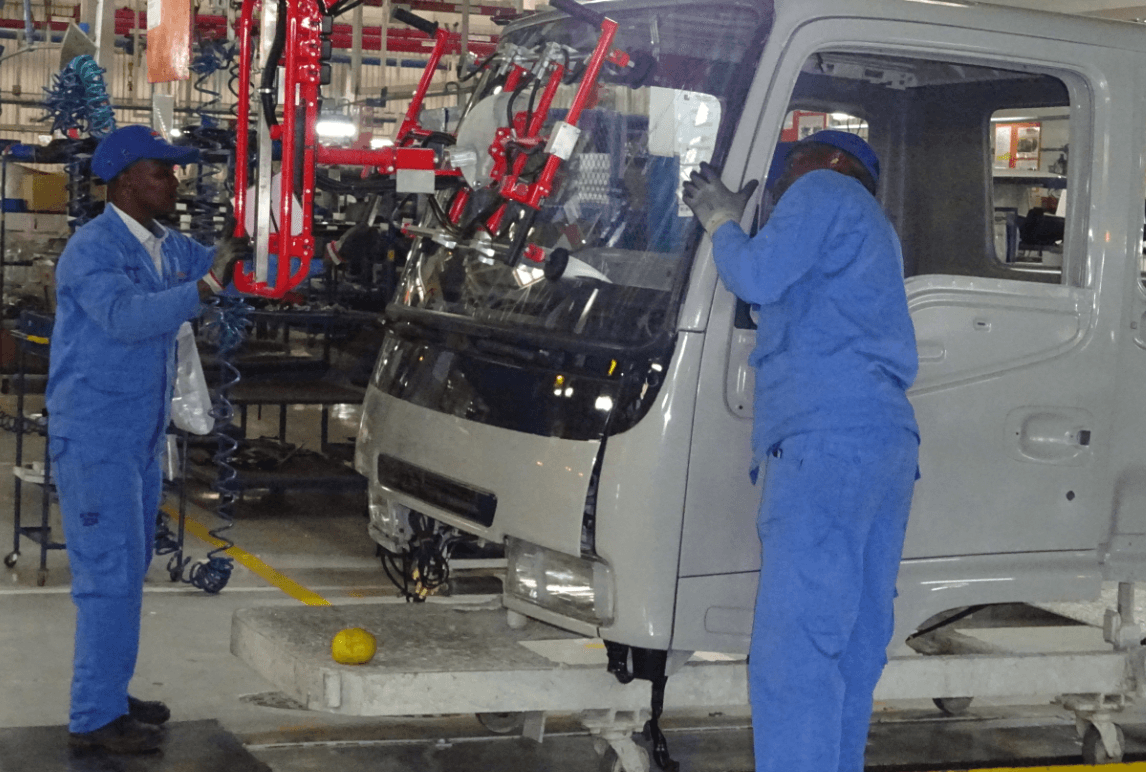

KDC is a development finance institution that merged the operations of the Industrial and Commercial Development Corporation, Tourism Finance Corporation and IDB Capital Limited.

According to the corporation, the initial loan amount issued in the legacy portfolio was Sh1.36 billion out of which Sh848.7 million has since been repaid.

It explained that the growth in the loan balances to the current amount of Sh31.8 billion was occasioned by the accrual of interest and penalties amounting to Sh30.45 billion.

“These unsecured loans were disbursed under the “Kenyanisation Programme” as part of the government’s initiative to empower its indigenous citizens after independence,” it said.

KDC added that it and its predecessors experienced difficulties in recovering loans after the businesses collapsed due to changes in the economic landscape, majorly the liberalisation of the economy.

Most of the borrowers, it said, are long deceased and it has been difficult to liquidate the securities.

In the audit report, Gathungu stated that the corporation has declared Sh33.44 billion or 86 per cent of its total loans’ portfolio as non-recoverable.

In addition, the securities related to some of the old non-performing loans being borrowers’ ancestral lands, were reported to be missing, impaired, or irredeemable.

As such, the corporation has stopped accrual of interest on the loans – denying itself the much-needed funds – in line with the set rules.

“The Board of Directors has approved the full provision for the losses totalling Sh33.44 billion against the corporation’s reserves as required by International Financial Reporting Standard No.9,” the report says.

But in the statement, KDC said it decided in line with the set-out rules.

KDC resolved to adopt the “in duplum rule” as set out in Section 44A of the Banking Act and as enforced by various courts and the corporation stopped accruing interest on these legacy loans in March 2022.

The rule requires that interest accrued should not exceed the principal amount outstanding when the loan becomes non-performing.

“Of significance to note, the total legacy portfolio is fully provided for in accordance with accounting standards and hence carries a nil book value in the financial statements,” KDC said.

The agency said it is in the final stages of restructuring the Legacy Loan Portfolio in compliance with the induplum rule.

KDC said it has maintained a strong credit appraisal system coupled with monitoring the performance of the loans.

KDC’s active portfolio currently includes 171 loan accounts that include loans taken over from the three merged institutions (excluding the legacy loan book discussed above) and loans that have been disbursed after the July 2021 merger.

“As of July 1, 2024, the 171 loan accounts have a total outstanding amount of Sh7.098 billion, spread across various economic sectors,” the agency said.

Tourism accounts for a significant proportion of the portfolio at 31.25 per cent followed by Agriculture, Fishing, hunting and forestry at 28.44 per cent and Manufacturing at 14.25 per cent.

“The overall Portfolio at Risk has greatly decreased from what it was during the merger (78 per cent) to the current 50.30 per cent as of the end of FY 2023-24. This reduction has been due to increased recovery efforts and enhanced credit appraisal and monitoring systems in place,” KDC said.