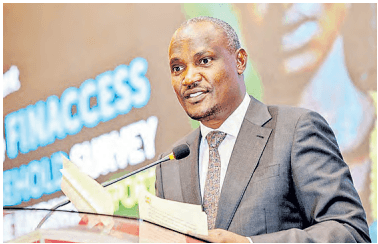

just six months ago, proposals to increase taxes triggered deadly nationwide protests that forced the administration to withdraw the Finance Bill 2024 and make far-reaching changes in its ranks. In the changes, Ruto co-opted opposition leaders into his broadbased government to cool the political temperature threatening the continuity of his then two-year-old regime. With a new budget cycle set to begin in two weeks, the government will submit a Budget Policy Statement to Parliament. The focus will be on the Treasury and Parliament, and the resultant reactions should they approve more taxes. Ruto’s big predicament is that increasing taxes could trigger fresh public outrage, while the status quo will leave the government with a huge fiscal deficit. Just last week, the Star reported that the government had breached its borrowing limit. This means the Kenya Kwanza administration has no more wiggle room to take loans.National Social Security Fund contributions are set to increase from February, coming just months after the implementation of new SHA rates and Housing Levy. The BPS is a government document that outlines policy goals and strategic priorities for the national and county governments. It includes the financial outlook for the next financial year and medium term, including government revenues, expenditures and borrowing. The fear of more taxes and levies has been evident in recent weeks as the Treasury has been continuously engaging the public on its intentions. The 2024 experience has left policymakers hesitant to propose new taxes. While increasing taxes would potentially result in another wave of protests, retaining the status quo would leave government with glaring fiscal gaps in its development and loans repayment plan. In an interview with the Star, National Treasury Cabinet Secretary John Mbadi said the government will introduce minimal taxes in the coming budget. “I don’t think Kenyans should brace themselves for any high taxes because we have made a commitment that we are not going to introduce any punitive taxes,” he said. “It is in line with our tax policy to have a predictable tax regime. The reason we had some changes previously was because when you come up with a new policy you have to settle in; we were settling in. “Going forward, we will see minimal changes on taxes. We will start with this year. I don’t see us having many proposals, especially those that are going to increase the taxes.” The CS said the measures will become clearer in a couple of weeks. “In the next two weeks, things are going to get clearer, in terms of the BPS and the roadmap of budget estimates,” he said in a telephone interview. Even with that assurance, opposition leaders have warned the government against attempts to increase taxes, threatening to rally Kenyans back to the streets. Wiper leader Kalonzo Musyoka last year told government to avoid provoking Kenyans with new taxes. He was responding to proposals by the National Treasury to introduce new taxes from the withdrawn Finance Bill, especially the taxes that were largely non-contentious. Machakos Governor Francis Mwangangi told the Star Kenyans will protest against any attempt to introduce taxes. “There is a likelihood that Kenyans, if they feel highly taxed, will go back to the streets,” he said. “They (Kenyans) are seeing a big budget for the executive, which does not help this country at all. Kenyans do not see value for the high tax that is extracted from them; when they do not see the value, you can expect them to come to the streets to demand for their rights.” Mwangangi, elected on a Wiper ticket, called for thorough public participation during the budget process to make Kenyans part of the deliberations. He said the government must do all it can to ensure the country does not experience another round of protest shutdowns that bleed the economy. “Kenyans have known their rights and they can agitate for them, no matter how many are kidnapped,” Mwangangi told the Star. “When there is that kind of unrest, the country loses so much, business loses more, and Kenyans are stressed more.” It is estimated the government lost more than Sh6 billion during the June 2024 anti-tax protests, Government Spokesperson Isaac Mwaura said. Veteran activist Suba Churchill called for a more inclusive process during the budget process to forestall any uprising. The human rights defender said Kenyans will more likely support a process in which they feel their views are sought and incorporated. “The clincher in all these is meaningful involvement of people and being sensitive to public sentiments,” Suba told the Star. “What led to the uprising against the previous Finance Bill was the perception that the government started in 2023 to appear insensitive to public opinion, and every time people raised concerns, the chairman of the Finance Committee kept dismissing those concerns. “We would want to see meaningful public participation,” Churchill said. “Treasury Cabinet Secretary Mbadi has been going out of his way, including getting input from professionals, putting adverts to enable people to ventilate, and making proposals on how some of the issues should be handled.” Meanwhile, Treasury is in the process of preparing the second and last supplementary budget to be tabled in the House at the end of this month. Mbadi says he is moving away from past situations in which government would present more than two supplementary budgets to Parliament. “We are now putting together the Budget Policy Statement and also putting together the supplementary budget two for 2024-25, which should be in Parliament by January 31,” he said. “For me, that should be the last supplementary budget. We don’t want to get into the bad habit of preparing too many supplementary budgets. Unless something drastic happens, we should have the last and final supplementary budget, which is what we are working on now, looking at the revenue and expenditure performance.”