President William Ruto faces yet another rough patch in this year’s budget cycle in the wake of a funding shortfall of about Sh760 billion.

The Kenya Kwanza on Thursday unveiled a Sh4.5 trillion spending plan for the period starting July 1.

Of the amount, the executive has been allocated Sh2.7 trillion while Parliament is set to get Sh2 billion more to put its allocation at Sh42.4 billion.

The Judiciary has been allocated Sh25.6 billion, going up by Sh3 billion compared to the Sh22.5 billion of the current year.

The 2025 Draft Budget Policy Statement reveals that counties would get Sh405 billion as sharable revenue. Sh1.3 trillion has been set aside for the Consolidated Fund Services even as government spending increases by Sh500 billion.

Treasury data shows that the Kenya Kwanza administration is eyeing revenues of Sh3.5 trillion against an expenditure of Sh4.5 trillion.

It includes Sh3.1 trillion in recurrent expenditure, Sh805 billion for development, Sh443 billion for counties and Sh5 billion for the contingency fund.

But even as Ruto’s team seeks to scale up its spending, the elephant in the room of a constrained fiscal space remains unmoved.

Considering the projected revenues and expenditure, Kenya Kwanza seeks to borrow Sh213 billion from foreign lenders and Sh545 billion locally.

“The domestic debt market remains one of the fundamental funding sources as it has contributed to more than half of the total funding requirements over the years and mitigates against shocks in the external debt market,” Treasury said.

The ensuing trouble, however, is that the Ruto administration has no further room for borrowing.

Controller of Budget Margaret Nyakang’o recently flagged the government’s appetite for loans after the debt stock hit Sh10.8 trillion.

It emerged that the stock as of September 30, 2024, translated to 67 per cent of the country’s total wealth which is estimated at Sh16.1 trillion.

Presently, the law has set the public debt ceiling at 55 per cent of the gross domestic product; hence the current stock is 12 per cent higher.

In the ensuing circumstances, Nyakang’o concluded that the government had surpassed the set debt limit hence in breach.

She recommended that borrowing should only be undertaken to finance productive projects and for the National Treasury “to pursue economic policies that support accelerated economic growth to enable the country to grow out of debt in the long run.”

Experts hold that the red flag begs the question of how the government would fund the upcoming spending cycle amid popular dissent.

Johnson Nderi, an economist from consultancy firm ABC Capital, said, “They (Kenya Kwanza) don’t have the fiscal space.”

He said the situation has been made worse by the failure of the government of the day to tame unnecessary spending.

“They have done a bad job at cutting spending. The fiscal sustainability picture is not good,” Nderi said.

He cited the government’s challenges with paying pending bills of more than Sh600 billion, most of which remain unsettled.

The new budget shows that the public debt settlement would gobble Sh1.5 trillion in the next financial year.

Experts hold that the drop in tax revenues as noted in November 2024 should be a warning sign of imminent troubles.

Treasury has in the draft BPS painted the picture of challenges with sharing of revenue with no room to borrow.

“It should be noted that after taking into account all the mandatory expenditures under Article 203(1) of the Constitution, the balance left for sharing between the two levels of government is Sh561.7 billion,” the BPS reads in part.

Treasury points out that after allocating Sh417.96 billion to county governments for FY 2025-26, being Sh405.07 billion as equitable share, Sh2.9 billion and Sh9.9 billion as unconditional and conditional allocation, the national government is left with only Sh143.7 billion.

This is the amount that is expected to finance functions such as education, health, defence, roads and energy among others.

“This may occasion additional borrowing which may distort the fiscal framework already set out in the 2025 Budget Policy Statement,” the Treasury said.

Budget experts have warned that an increase in borrowing will affect the cost of borrowing and increase debt servicing expenses.

“More loans would further crowd out resources for development and other critical recurrent expenditures in the medium term,” the Parliamentary Budget Office said.

Despite the bleak picture, the Kenya Kwanza administration appears keen on implementing the bottom-up plan.

The BPS indicates that resources would be allocated based on how they help actualise the priority programmes.

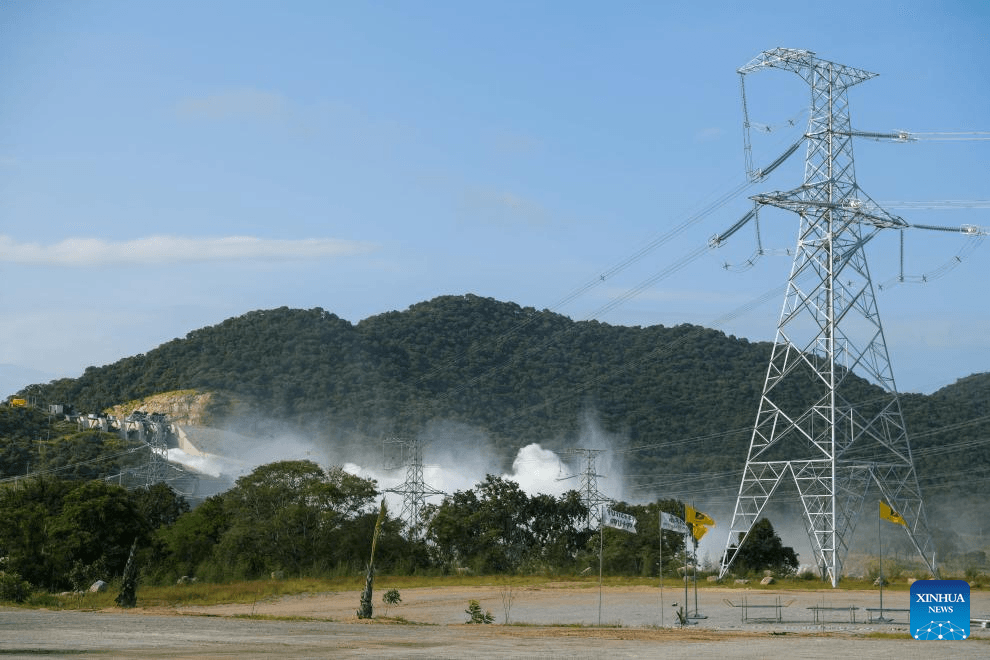

As such, the BPS has capped the agriculture budget at Sh86 billion, Sh554 billion for energy, infrastructure and ICT projects, Sh204 billion for health, and Sh718 billion for education.

The amounts are higher compared with last year’s estimates which were reduced after the collapse of the Finance Bill, 2024.

About Sh268 billion would be set aside for the governance sector, Sh360 billion for public administration, Sh279 billion for national security, Sh78 billion for social protection and Sh134 billion to environment, water and natural resources.

In the agriculture sector, the government plans to issue 1.3 million title deeds, digitise land records in 15 offices, settle landless households, distribute 640 milk coolers and distribute 570,000 tonnes of fertiliser.

Plans for infrastructure include 1,098km of roads, 62 bridges and completion of railway projects and fast track construction of the Nairobi Railway City project.

Treasury says the government will sustain measures to strengthen expenditure control and improve efficiency and effectiveness in public spending.

“These measures will include: implementation of austerity measures aimed at reducing government recurrent expenditure; roll out an end-to-end e-procurement system to maximise value for money and increase transparency in procurement,” the BPS reads in part.

Treasury further says it would scale up the use of the Public-Private Partnerships framework for commercially viable projects “to crowd-in the private sector in the provision of public services.”

Kenya Kwanza states that it would

also expedite governance reforms

targeting state corporations besides

implementing of treasury single

account, and accrual accounting,

as well as a zero-based budgeting

approach.