Kenya’s fiscal position has received a boost after global credit rating agency, Moody’s, revised the country’s credit outlook from “negative to positive.”

Moody’s, however, affirmed that the local and foreign-currency long-term issuer ratings and foreign-currency senior unsecured debt ratings still stand at CAA1.

Moody’s cited potential ease in liquidity risks and improving debt affordability over time for the positive rating.

It also observed elevated credit risks driven by very weak debt affordability and high gross financing needs relative to funding options.

"Given low inflation and a stable exchange rate, there is potential for further reductions in domestic borrowing costs as past monetary policy rate cuts pass through to lower long-term borrowing costs," Moody's said.

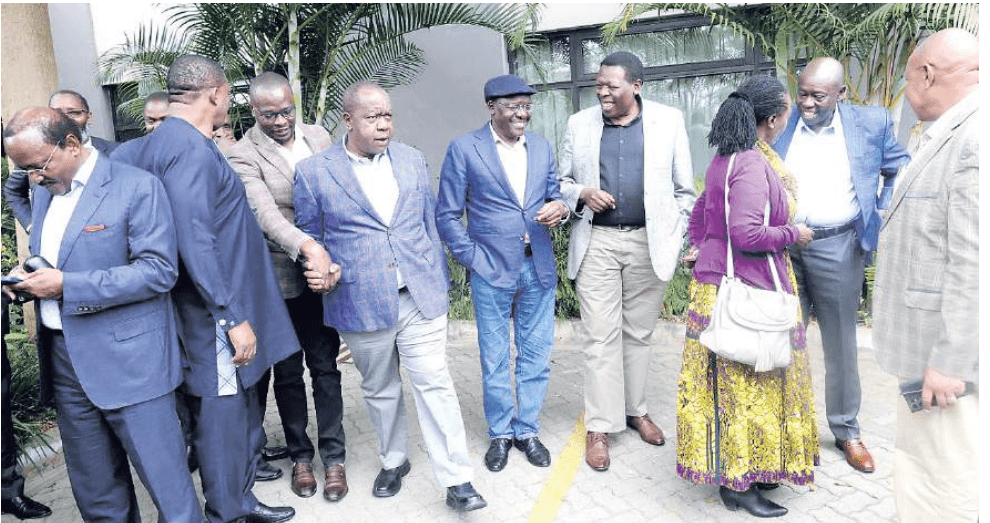

Kenya has been struggling with heavy debt and looking for new financing lines since last year due to nationwide protests against proposed tax increases.

Moody’s said domestic financing costs have started to decline amid a monetary easing cycle and this could continue if the Kenyan government effectively manages its fiscal consolidation.

This could open doors for external funding options, the report said.

“Domestic financing costs have started to decline amid monetary easing and could continue to do so if the government sustains its more effective management of social demand and fiscal consolidation. Such a track record would also boost Kenya’s access to both concessional and commercial external funding,” Moody’s said.

“Revenue collection efforts, if successful, present the potential for further improvements in debt affordability, although Kenya has struggled to expand revenue significantly and durably in the past, notwithstanding recent measures.”

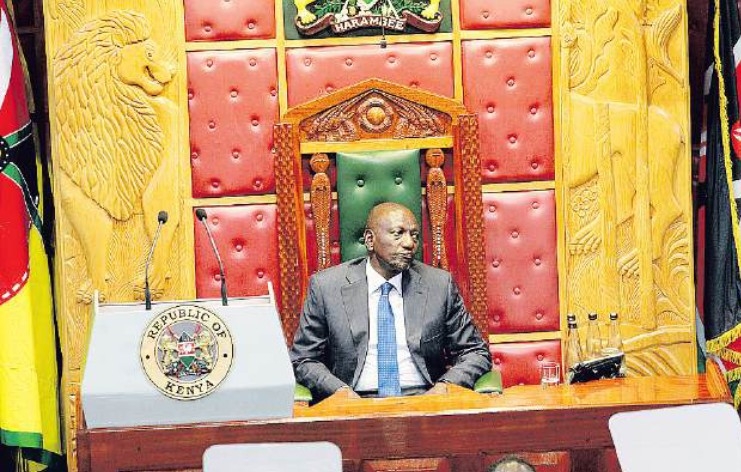

Moody’s downgraded Kenya’s credit sustainability to CAA1 last year a week after President William Ruto declined to assent the Finance Bill 2024 to law following nationwide protests and public outcry.

The country moved from B3 rating, whereby the country’s debt obligations are speculative and subject to high credit risk

Moody’s said the rating has revealed that the country’s fiscal policy effectiveness is limited by weak institutions, policy unpredictability, and high consumption levels, hindering revenue collection.

Additionally, Kenya also faces significant liquidity risks and environmental and social challenges.

“Supporting Kenya’s rating are fundamental credit strengths including a large, diversified economy that has shown resilience to shocks and benefits from a relatively developed capital and credit markets, enabling the government to issue long-term domestic debt in local currency,” the agency added.

Moody’s announced that Kenya’s local currency (LC) ceiling

remains at B1, maintaining a three-notch difference with the sovereign rating.

Moody’s explained that this reflects relatively weak

institutions and policy predictability, and moderate political risk set against

a relatively small footprint of the government in the economy and limited

external imbalances.

The foreign currency (FC) ceiling remains at B2, one notch below

the LC ceiling, which reflects relatively high mortality rates, which constrain

Kenya’s human capital.

“The influence of governance on Kenya’s credit profile (G-4

issuer profile score) captures Kenya’s weak fiscal policy effectiveness as well

as high levels of corruption and weak rule of law. Low wealth levels and an

already high debt burden limit the degree of resilience,” Moody’s added.