How Lipa Na M-PESA led to business transformation

It has made life easier for traders and customers alike

It revolutionised financial transactions across Africa via seamless payments.

In Summary

M-Pesa started as a domestic mobile money platform in 2007, giving millions of unbanked Kenyans access to financial services.

Fast-forward to today and the service has evolved into a financial powerhouse, extending its reach far beyond Kenya’s borders.

The launch of M-Pesa Global was a game changer, allowing users to send funds to bank accounts, mobile numbers and Western Union locations worldwide.

For Kenyan businesses and freelancers, this innovation has been a blessing. Safaricom chief financial services officer Esther Waititu said the company is dedicated to financial empowerment.

Once individuals reach adulthood, she said, they gain the freedom to invest and grow their wealth using the platform.

“When you’re over 18, you can do lots of things,” Waititu said. “At M-Pesa, we are giving our customers the liberty to invest and to multiply their wealth using our platform and leveraging technology in a way that becomes seamless.

“The future we are creating for M-Pesa is a financial services platform that drives innovation, brings financial services together and provides the most robust ecosystem you can find on this continent.”

Waititu said M-Pesa is revolutionising financial transactions across Africa by enabling seamless cross-border payments and fostering regional trade.

She said M-Pesa’s model is being adapted across different markets to enhance financial inclusion. “With more than 60 million customers in seven markets, Safaricom’s mobile money platform has grown into a powerful financial ecosystem that supports businesses and individuals in accessing global markets,” Waititu said.

“We’re able to transform payments across Africa by lifting the M-Pesa model and making it relevant in different regions. As an open and instantaneous platform, the first thing we do is enable payments across different borders.”

Through international remittance services and M-Pesa Global Pay, she highlighted how users can send and receive money across multiple countries, making trade more efficient.

“This has helped eliminate the barriers posed by traditional banking systems, particularly in areas where financial infrastructure is limited,” she said.

“Beyond payments, M-Pesa is expanding its credit solutions to new markets. We have taken some of the learnings from Kenya and applied them in markets like Tanzania, where they can use similar insights to expand credit access.”

STRATEGIC COLLABORATIONS

A tactic that helped to drive growth is strategic collaborations. M-Pesa partners with Visa to enhance digital payment solutions and with Alipay to facilitate seamless transactions between Kenya and China, creating opportunities for e-commerce expansion.

“By leveraging partnerships and innovation, M-Pesa continues to shape Africa’s digital financial landscape. Its ability to provide instant, secure and borderless transactions ensures businesses and individuals can thrive in an increasingly globalised world,” Waititu said.

With its growing influence, M-Pesa is not just a mobile money service but a catalyst for economic transformation across Africa, empowering millions with financial freedom.”

Before M-Pesa Global, businesspeople struggled to receive payments from international clients, but now that has changed.

Parents have also been able to send their children school fees or even upkeep money within seconds.

No lengthy bank processes, no hidden charges, just instant, seamless transfer. This is the power of M-Pesa Global.

At the same time, for many Kenyans living abroad, M-Pesa Global has made it easier to support their families back home.

Mary Gathoni, who works in the US, can send money to her parents efficiently.

“I send money directly to their phones while seated in my house. I don’t have to go to the bank, neither do my parents. They also don’t need a bank account, and they receive it instantly,” she said.

“It’s a relief to know that I can send funds to my family in real time. I don’t have to worry about money taking days to arrive,” she said.

M-Pesa’s expansion beyond Kenya has further solidified its role as a financial inclusion tool. In 2023, Safaricom PLC joined forces with Mastercard in a strategic partnership designed to expand payment acceptance and streamline cross-border remittances across Kenya.

This collaboration was set to strengthen the country’s growing mobile payments landscape, offering significant advantages to merchants who rely on M-Pesa, Safaricom’s widely used mobile money platform.

The partnership is expected to deliver substantial benefits to more than 636,000 merchants who currently depend on M-Pesa for payment processing.

By combining Mastercard’s global payment network with M-Pesa’s vast merchant base, this collaboration aims to provide seamless, secure payment solutions, empowering businesses to expand, access international markets and handle cross-border transactions with ease.

CASH REMITTANCE

In December 2014, the Central Bank of Kenya granted Safaricom a cash remittance operating licence, positioning the company as a direct competitor to banks and forex bureaus that traditionally facilitated outward remittances.

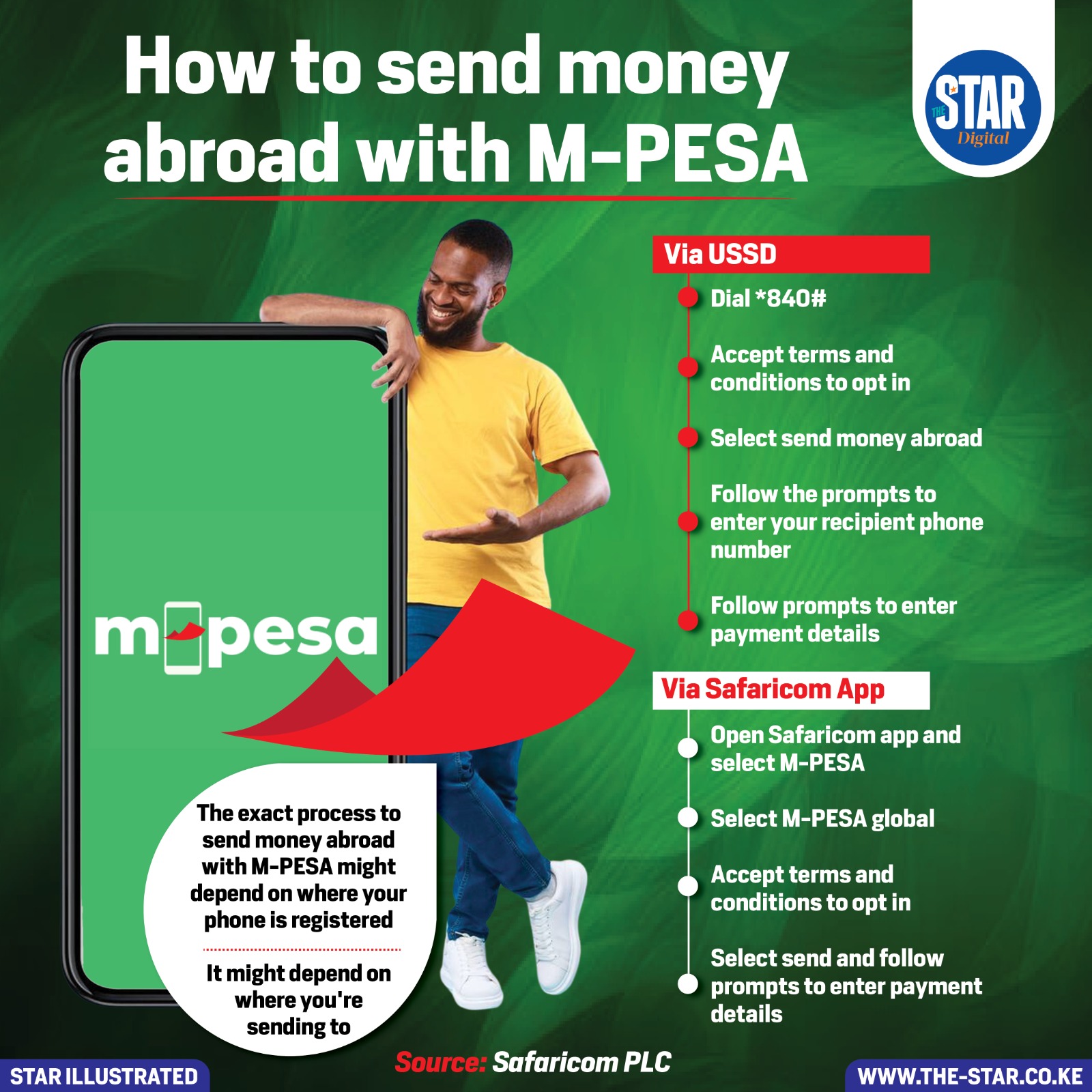

This milestone allowed M-Pesa to expand its services beyond inbound international transfers, enabling users to send money abroad for the first time.

Previously, Safaricom’s licence restricted it to receiving funds into Kenya through partnerships with global money transfer providers like Western Union and MoneyGram.

Under the old licensing terms, Safaricom was not allowed to handle outward cash transmission even to neighbouring Uganda and Tanzania.

Recognising the transformative impact, Safaricom expanded M-Pesa services beyond Kenya.

M-Pesa has entered several countries, including Tanzania (April 2008), the Democratic Republic of Congo (November 2012), Mozambique (May 2013), Egypt (June 2013), Lesotho (July 2013), Ghana (December 2015) and Ethiopia (August 2023).

M-Pesa Africa managing director Sitoyo Lopokoiyit said one of the key reasons for M-Pesa’s success is the dedication and passion of the team behind its launch, including industry leaders like Michael Joseph, Nick Hughes, Susie Lonie, Pauline Vaughn, Joseph Mudigi and Catherine Gichunge.

“What they had was the passion to transform lives, and that’s the DNA that has been part of M-Pesa to this day,” Sitoyo, who is also the acting chief financial services officer, said.

This commitment continues to drive M-Pesa’s evolution, adapting its services to fit the economic and social needs of each market.

BUMPS IN THE ROAD

M-Pesa’s journey has not always been smooth. The platform has experimented with markets such as India, Romania and South Africa, with varying degrees of success.

However, its stronghold remains in Tanzania, Mozambique, the Democratic Republic of Congo, Lesotho, Ghana, Egypt and Ethiopia, where it continues to thrive.

In Tanzania, where mobile penetration is high, the platform plays a crucial role in financial transactions. The gap between telecom subscribers and M-Pesa users is just two million, reflecting the deep integration of mobile money into daily life.

“Tanzania is about twice the size of Kenya, and the importance of M-Pesa becomes even more pronounced,” Sitoyo said.

“The competitive market environment drives constant innovation in both GSM and mobile financial services.”

Notably, Tanzania was the birthplace of Pochi la Biashara, a service that allows traders to separate their personal and business M-Pesa accounts.

Additionally, the country introduced the name Fuliza, the overdraft service launched in Kenya in January 2019, which became an instant success.

In Mozambique, where Portuguese is the official language, M-pesa provides a comprehensive suite of services, including payments, lending, wealth management and insurance.

Meanwhile, Lesotho, though the smallest geographical market, boasts the highest M-pesa penetration among all regions.

The Democratic Republic of Congo, with its population nearing 100 million, presents both opportunities and challenges.

It is the only market where M-pesa operates in dual currencies, reflecting the complexity of financial transactions in the region.

“The good thing is that at M-Pesa Africa, we built a uniform platform, so all markets have the same capabilities for products and services. It is up to the market heads to open relevant services based on local demand,” Sitoyo said.

Ethiopia became M-pesa’s newest market in 2023, just seven months after Safaricom Ethiopia launched telecom services in the country.

As of December 2024, M-pesa Ethiopia boasts 10.8 million customers. Safaricom Ethiopia CEO Wim Vanhelleputte pointed out that Ethiopia’s financial landscape differs significantly from Kenya’s.

Unlike Kenya, where M-Pesa initially served an unbanked population, Ethiopia has more than 30 banks and 8,000 branches.

The primary challenge in Ethiopia lies in replacing cash transactions with digital payments, as the Ethiopian Birr is a bulky currency.

“What we are solving in Ethiopia with M-pesa is the digital payment issue. If you want to be successful with a new product, you need to solve a real problem for customers. In Ethiopia, replacing cash payments with digital transactions is that problem,” Wim said.

The shift towards digital payments is already taking shape, with nearly a third of M-Pesa Ethiopia’s customers adopting digital channels over USSD transactions.

“Using a smartphone for USSD transactions doesn’t make sense when you have a well-designed app. We are actively educating customers to embrace the app experience,” Wim said.

It has made life easier for traders and customers alike

In Ethiopia, M-Pesa is solving the cash dependency problem.

M-PESA was officially launched in Ethiopia on August 16, 2023.