More than Sh1 billion worth of investments by the National Social Security Fund is at risk of going down the drain over mess in receiving companies.

An audit query says NSSF may not get any income from the hundreds of millions it invested in the cash-strapped firms.

The cement and tyre companies that NSSF put contributors’ money on are either broke and under receivership or face closure.

Details show that NSSF pumped Sh221 million on shares at Athi River Mining Company, East African Portland Cement Company and Sameer Africa Company.

Auditor General Nancy Gathungu in her review of NSSF books of account for June 30, 2022, said she could not confirm the fair evaluation of the quoted investment.

“The accuracy and fair evaluation of the investment of Sh221,601,474 in the three companies could not be confirmed,” she said.

Gathungu said Athi River Mining was liquidated and eventually delisted from the Nairobi Securities Exchange.

The company, the auditor general said, did not spring back to vibrancy after more than two years under an administration which failed to revive its operations.

“Moreover, the company’s stock was suspended from trading on the NSE indefinitely, effective May 8, 2020,” she said.

At East African Portland Cement Company, the auditor said the revenues have been declining amid reduced sales.

Kenya Commercial Bank, the audit reveals, has also attached a debenture to all the company’s assets in demand for the repayment of an outstanding debt of Sh6 billion.

Gathungu said Sameer Africa was also struggling financially and hence did not assure a return on investments on the 2.8 million shares NSSF acquired at the firm.

She cited the company’s recent revelation in the 2020 annual report that it had declared 107 positions redundant – saving Sh245 million in staff costs to cover losses.

The auditor general further said an alarm bell comes in the profit warning Sameer Africa issued in August 2022.

“Sameer Africa issued a profit warning for the year ending December 31, 2022 citing global disruption in its supply chain which then impacted the availability of key products for its tyre business,” she said.

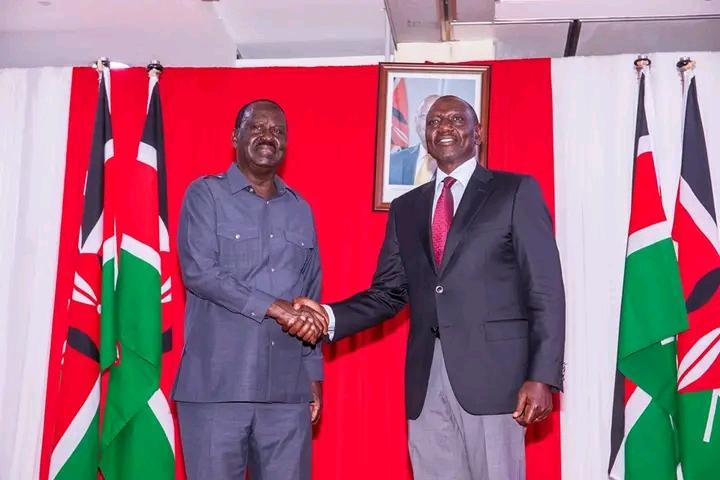

When President William Ruto sought the increment of workers’ mandatory contributions recently, the top question was whether NSSF would invest the monies prudently.

An investment of Sh425 million in a building at Mombasa – Hazina Plaza, has also been red-flagged for non-performance.

NSSF bosses are further on the spot for spending more than two per cent of the contributors’ cash [total fund assets] on operations.

The National Social Security Fund Act, 2013 says the total expenses for the administration of the fund should not exceed two per cent.

Managers surpassed the cap of Sh5.7 billion by Sh1.7 billion, translating to 0.6 per cent above the set threshold.

Old Mutual, CIC Asset Management, Sanlam Investments, Gen Africa Investment Management, African Alliance Asset Management and Coop Trust Investment Services were the NSSF fund managers behind the investments.

Gathungu said the fund managers have full control of and unrestricted power to invest the funds’ money as per the investment policy for maximum returns to the trustees.

However, two other companies where NSSF invested more than Sh408 million did not declare dividends on the millions.

NSSF bought ordinary shares worth Sh86 million and preference shares of Sh161 million at Consolidated Bank.

The fund invested another Sh161 million to buy 1,116,460 shares at UAP Holdings, monies which Gathungu said are not helping the contributors.

“The fund continues to hold investments with no return by way of dividends or capital appreciation,” she said.

“The carrying valuation for the investment in the three companies has not been determined. In the circumstances, the accuracy and fair valuation of the unquoted stocks could not be confirmed.”

In the case of Hazina Plaza in Mombasa, the auditor general said her inspection revealed that the building was wasting away.

She said the building was found vacant and was in a dilapidated state.

It is also emerging that the tenants, who were evicted on March 18, 2019, for rent default had extensively damaged the property.

The report says the lot claimed that they had installed most of the items before they occupied the spaces.

“In the circumstances, the accuracy and fair evaluation of the investment in Hazina Plaza Polana Mombasa building valued at Sh425 million could not be confirmed,” Gathungu said.

The audit has also flagged delays in processing members’ benefits with details showing that more than 18,000 benefit claims were pending at the time of the audit.

“Pensioners and dependents were unable to access their money in time to cater for their basic and other needs due to the delay in claims processing.”

About 40 per cent of the claims were delayed by the situation of the agency deploying few fingerprint technicians who match the same to authenticate the claims.

Also flagged is Sh741 million which contributors’ employers have paid but have not been reflected in the individual member’s accounts.

Gathungu said no sufficient explanation was provided for the inability to reconcile and post the suspense balance of Sh741 million which had accumulated over the years.

![[PHOTOS] PS Omollo inspects key projects in Kuria](/_next/image?url=https%3A%2F%2Fcdn.radioafrica.digital%2Fimage%2F2025%2F03%2F0ea9f431-28a2-443a-ab34-b74114e1b2b0.jpeg&w=3840&q=75)