.jpg&w=3840&q=100)

Crackdown on mobile registration and investment in cyber security initiatives has cut malicious SIM swap fraud to only 40 out of every 750,000, according to Safaricom.

The Telco said SIM swap requests remain high, with approximately 28,000 swaps processed daily.

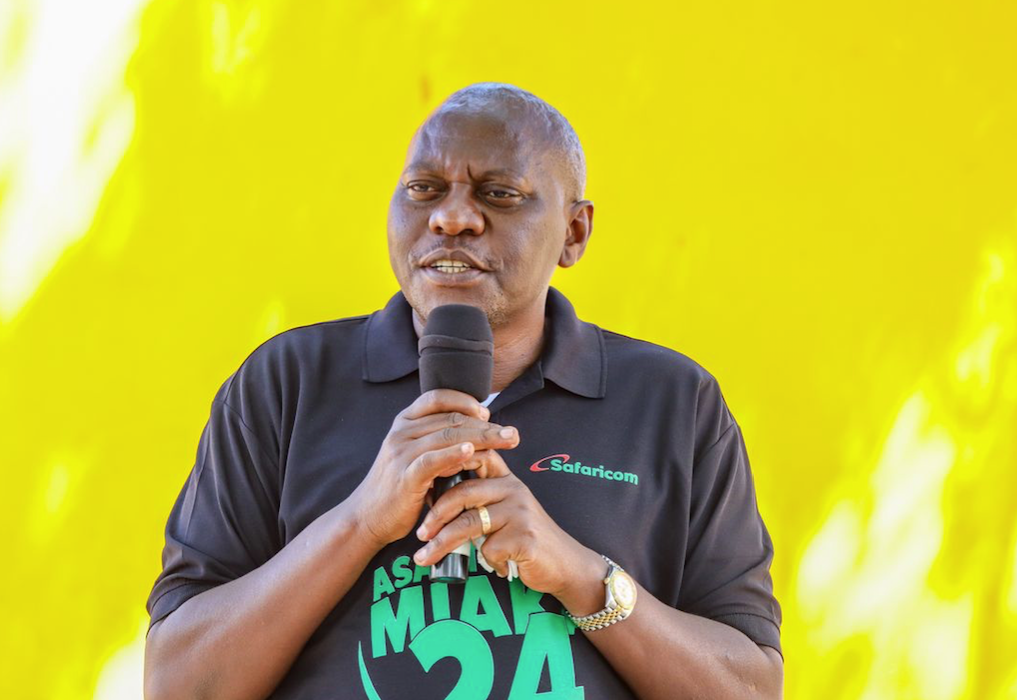

Safaricom’s chief corporate security officer Nick Mulila said majority of these requests stem from legitimate issues like lost or damaged SIM cards or upgrades as technology evolves.

He said fraudulent activities have persisted, though at a low rate relative to the volume of daily swaps.

“However, sometimes these controls are unable to predict accurately that the person presenting themselves to our touch points is who they claim to be. In a month we get about 40 fraudulent swaps out of about 750K swaps,” Mulila said.

SIM swapping allows customers to retain their existing number by obtaining a replacement SIM card, which is critical when a card is lost or damaged.

However, fraudsters have increasingly exploited this process to gain control of users’ phone numbers and access sensitive data, particularly M-PESA accounts.

Mulila acknowledges that Safaricom has implemented strict protocols to verify identities and deter fraud, but vulnerabilities remain.

“To further protect M-Pesa accounts, Safaricom temporarily blocks wallet access after swaps made through these partners, ensuring an additional layer of security,” Mulila said.

In an effort to further contain swaps and emerging threats posed by the adoption of the 5G technology, the telco has revealed plans to ramp up its cyber security investments.

As 5G networks gain traction globally, concerns about cybersecurity risks associated with this technology have intensified in recent months.

The CCSO points out that the increased adoption of 5G, which enables unprecedented speeds, reduced latency, and a massive increase in connected devices, has created new vulnerabilities that cybercriminals could exploit.

“To address these challenges, we are enhancing our edge security strategy by investing in advanced AI-driven security tools and real-time threat detection systems,” Mulila said.

He said these tools help detect and mitigate cyber threats as they happen, offering Safaricom’s network a more adaptive and responsive defence.

“We are also focusing on the security of network segmentation, ensuring proper isolation of each virtual network slice to prevent cross-contamination of data or threats,” he said.

According to the latest insights from the telecommunications regulatory body, Communications Authority, Safaricom had more than 11,000 business clients using 5G and more than 780,000 smartphones are active on its 5G network