Four million Kenyans who have not repaid Hustler Funds loans have a chance of tripling their limit if they clear outstanding amounts, President William Ruto has announced.

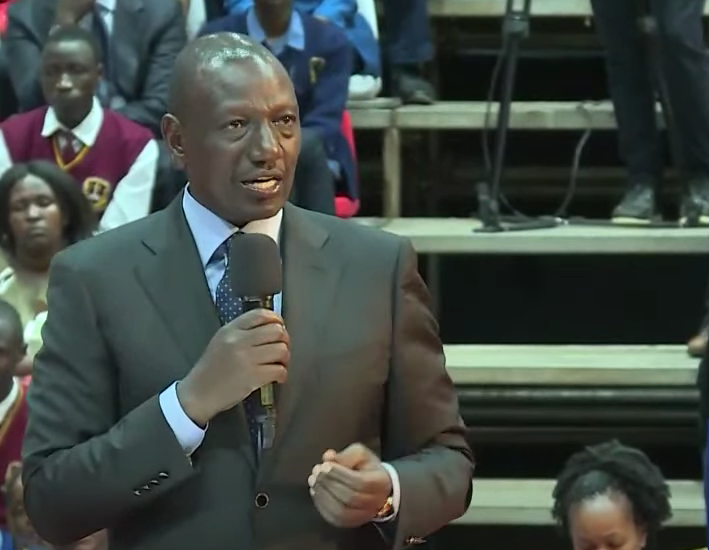

Speaking at a Town Hall meeting at the Kenyatta International Convention Centre in Nairobi, Ruto said noted that the four million borrowers are those with outstanding amounts or have not repaid on time.

“If they pay their outstanding amounts, the window for them to be moved to the Bridge Loan, which doubles or triples their credit limit exists,” he stated.

“The four million people out there who have not paid their money, they have a chance.”

The Bridge Loan product is designed for beneficiaries who have demonstrated good borrowing behavior.

It will provide enhanced loan limits and an extended loan term of 30 days, up from 14 days, with an interest rate starting at 8 percent per annum and a one-month roll with enhanced interest at 9.5 per cent.

Ruto said the government is keen to have many Kenyans come

on board.

“Once you pay, we are going to assess you for two months and then graduate you to the Bridge Loan,” the President said.

The President explained that Huslter Fund intervention seeks to remove the penalisation, the blacklisting, the condemnation of people and give them a chance to improve on their credit rating.

Since its launch in 2022, the Hustler Fund has provided critical financial support to millions of low-income Kenyans.

Kenyans took up the hustler loan in large numbers. As at August 2024, there were roughly 21 million borrowers. The Hustler Fund has the most active loans in the market, taking a 45 per cent share of the active loans in the digital lending industry.

In October 2024, the government announced plans to introduce a legal framework targeting loan defaulters. The proposed measures aim to recover defaulted loans by accessing funds directly from mobile money services like Mpesa accounts and mobile airtime.

The government seeks to recover Sh7 billion from around 13 million defaulters as of October 2024.

![[PHOTOS] Ruto's warm reception in Maua, Meru](/_next/image?url=https%3A%2F%2Fcdn.radioafrica.digital%2Fimage%2F2025%2F04%2F04296e3b-128d-4538-9d57-9475bcca83e9.jpg&w=3840&q=75)