Pension pot: New NSSF rates take effect next month

Deductions to double as fund adjusts contributions

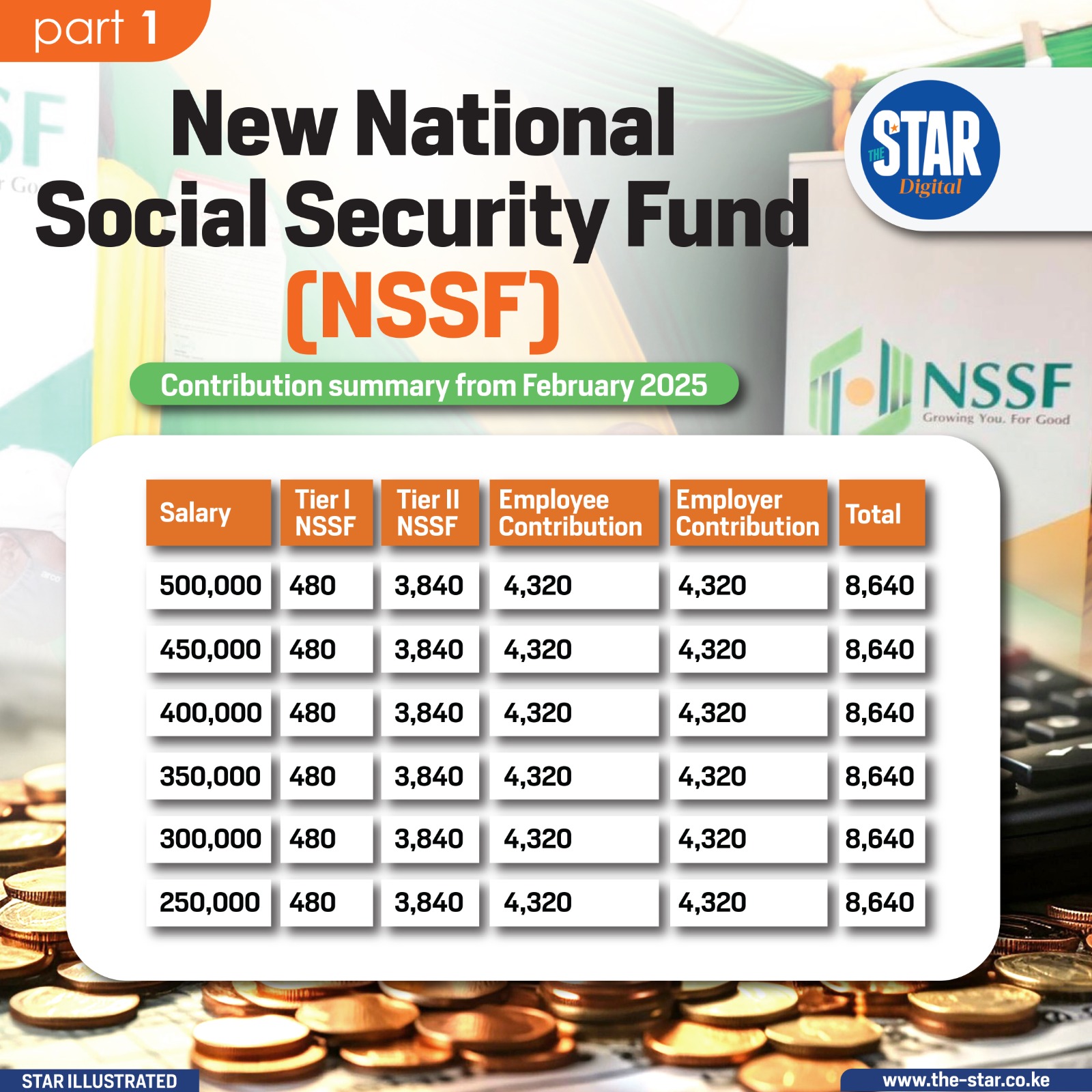

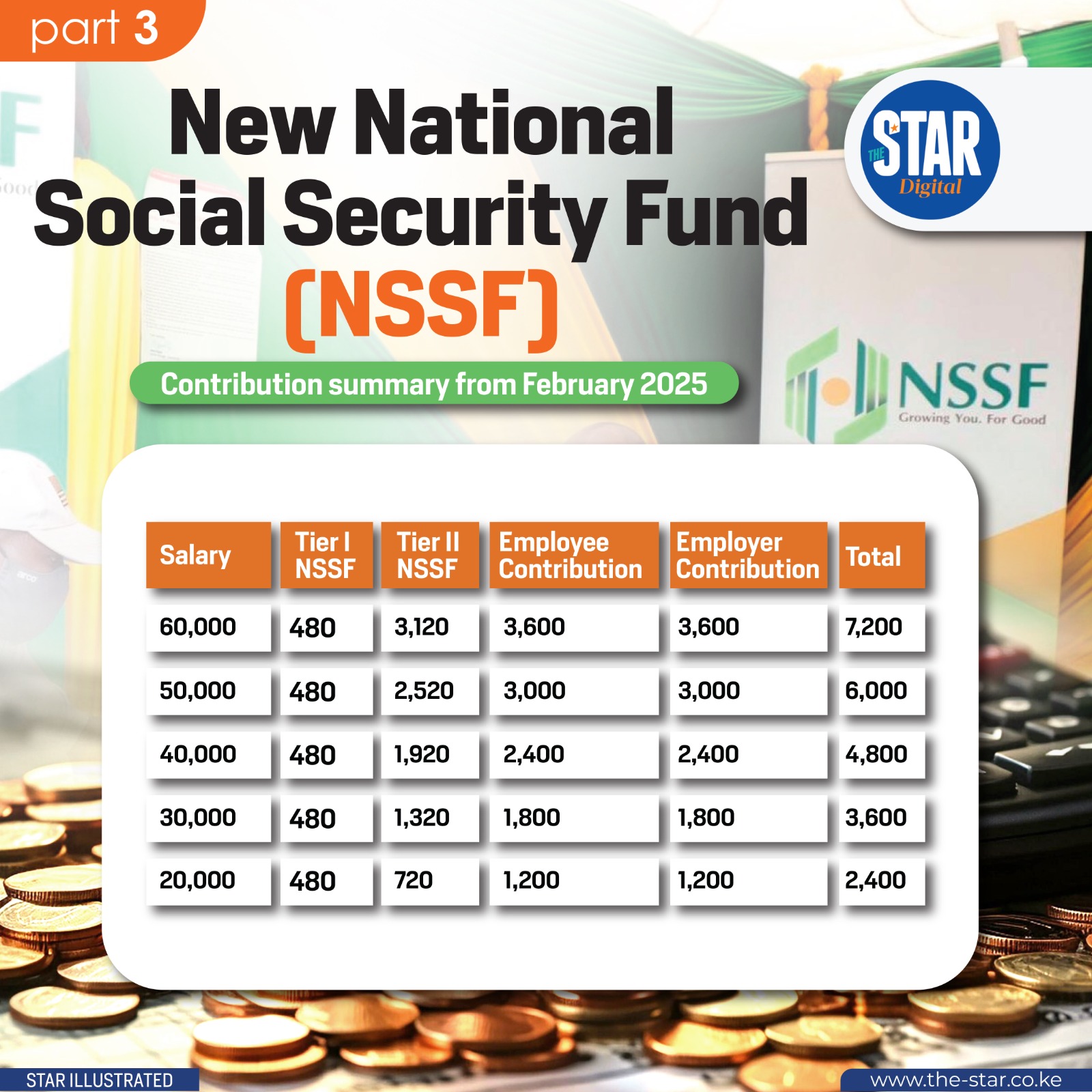

Based on salary tiers, the total contribution is Sh8,640 for salaries ranging from Sh80,000 to Sh500,000.

In Summary

The new National Social Security Fund (NSSF) contribution rates, effective February 2025, outline updated deductions for employees and employers.

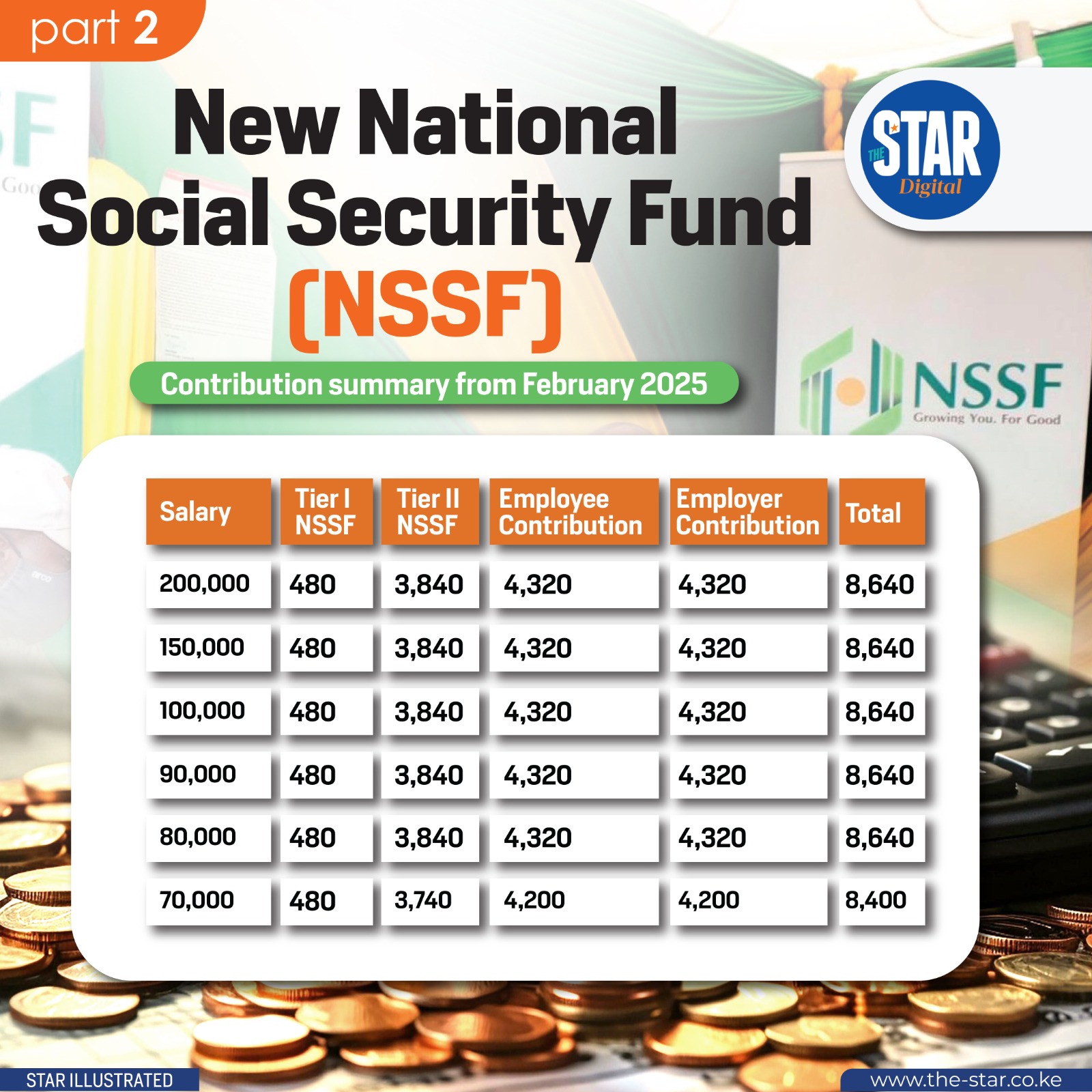

Based on salary tiers, the total contribution is Sh8,640 for salaries ranging from Sh80,000 to Sh500,000.

Those earning Sh70,000 will contribute Sh8,400.

Employees will contribute Sh4,320, matched equally by employers, while the Tier I NSSF deduction is Sh480 and Tier II is Sh3,840.

The National Social Security Fund is a Kenyan government agency responsible for the collection, safekeeping, responsible investment and distribution of retirement funds of employees in both the formal and informal sectors of the Kenyan Economy.

Participation for both employers and employees is compulsory. The fund is both a pension fund and provident fund.

Deductions to double as fund adjusts contributions