KRA reintroduces tax amnesty in push to help Kenyans clear tax debts

Your Second Chance at a Clean Tax Slate!

The expiration date for this amnesty drive is set for June 30, 2025

In Summary

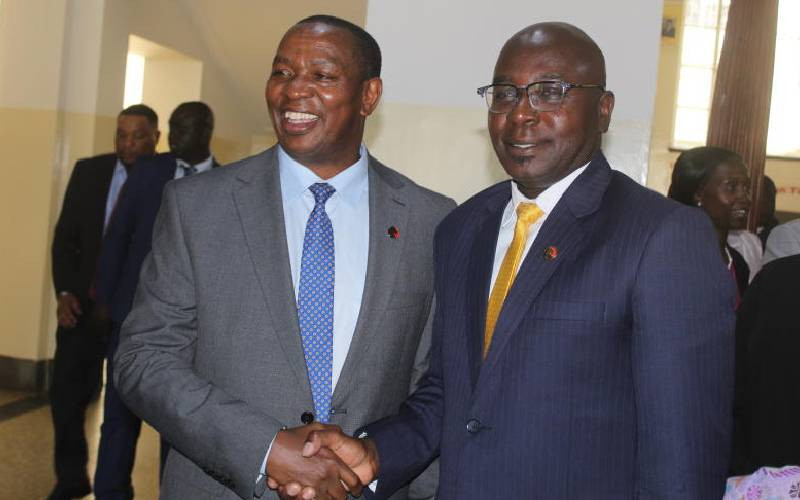

KRA Chairman Ndiritu Muriithi with Authority's Commissioner General Humphrey Wattanga/FILE

KRA Chairman Ndiritu Muriithi with Authority's Commissioner General Humphrey Wattanga/FILEIn these volatile and difficult economic times, many individuals and businesses are increasingly finding it difficult to fulfill their tax obligations.

Once combined with a lack of awareness about tax

compliance and a tendency to miss deadlines, it’s no wonder many businesses and

individuals rack up tax debts over time.

It’s for this and more reasons that KRA is launching Tax Amnesty 2.0; an initiative that involves the waiving of penalties, fines, and interest on tax debts accumulated up to December 31, 2023.

Given the success of a previous drive that benefited more than 3 million Kenyans with waivers totaling Sh507.7 billion, hopes are high that this year’s amnesty will be an even bigger success.

A CLEAN SLATE

In taking advantage of this amnesty, taxpayers aren’t just avoiding fines; they are presented with a clean slate that puts them in good financial standing.

This translates to easier access to bank loans, business opportunities, grants, and government services. Moreover, once financial credibility is restored, tax compliance becomes much easier.

As before, the application process for KRA is as simple and forthright.

Taxpayers only have to visit the iTax platform, head to ‘Debt and Enforcement,’ and click the Amnesty application tab.

HOW TO APPLY FOR TAX AMNESTY

Step 1: Using your browser, log in to ‘iTax,’ head to the ‘Debt and Enforcement’ menu, and select ‘iTax Amnesty Application.’

Step 2: Under section ‘A,’ select the respective tax obligation, e.g., Value Added Tax. This will populate the periods with principal tax for the specific obligation.

Where a taxpayer had more than one obligation, you click Add and select the other obligation, then go to B.

Step 3: Under section ‘B,’ propose the number of installments and installment frequency. The system shall compute the amount per installment.

Click to agree to the terms and conditions and ‘Submit’ to complete the process.

Step 4: Click to agree to the terms and conditions and submit. The iTax system will generate an amnesty application acknowledgement with amnesty and payment plan details.

Step 5: Generate payment slips for the respective tax obligation and tax period through iTax and proceed to pay via bank transfer or M-Pesa Paybill 222222.

Step 6: Once payment has been received, the iTax system shall vacate the respective penalties and interest for the period and issue an amnesty certificate.

For taxpayers whose only misstep is not filing their returns on time, they only have to file the specific returns to automatically enjoy amnesty.

For those who've accrued debt, however, following this step-by-step application process is key to enjoying the waiver. The expiration date for this amnesty drive is set for June 30, 2025.

To avoid the last-minute rush, visit the KRA website and make your application today. Once this period has elapsed, all unpaid taxes will yet again accrue interest and penalties.

In case of any queries, contact KRA on social media on X at KRA Care or Facebook at Kenya Revenue Authority.

You can also reach them by phone at +254 20 4 999 999 or +254 711 099 999, or via email at [email protected].

Your Second Chance at a Clean Tax Slate!